U.S. Small Business Owners Dismiss Hiring Incentives

With weak sales as a major challenge, four out of five U.S. small business owners will maintain or reduce their number of full-time employees over the next six months, and they see little value in proposed Federal incentives to create jobs, according to the PNC Economic Outlook survey’s newest findings – released Friday, Oct. 7.

Only 14 percent of businesses say proposed tax incentives will positively impact their hiring plans, PNC found, as owners’ expectations for sales and profits are significantly lower than last spring, ushering in renewed pessimism compared to six months ago.

In an article last month, RMN News Service had put forward similar arguments about President Obama’s jobs plan, saying: “Although Obama’s jobs plan promises tax cuts to businesses hiring local people, most will still be reluctant to chew this bait. It will be suicidal for them to hire new people when their business does not demand it.” (Read: Can Obama Jobs Plan Reduce Poverty in America?)

“As business confidence plunges to a near-record low, the concern is we will scare ourselves into a double-dip recession, thus turning it into a self-fulfilling prophecy,” said Stuart Hoffman, chief economist at The PNC Financial Services Group, Inc.

“These findings support our forecast that the economic recovery will persist, but the slow pace of growth will be insufficient to make any progress in lowering the nation’s painfully high unemployment rate in the coming year.”

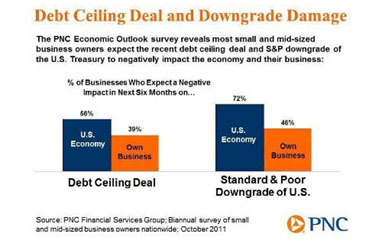

The survey, which gauges the mood and sentiment of small and medium sized business owners, also found that more than half (56 percent) expect the recent debt ceiling deal to have a negative impact on the U.S. economy.

Moreover, close to three-quarters (72 percent) expect the S&P downgrade of the U.S. Treasury to impact the economy negatively and nearly half (46 percent) expect it to adversely impact their own businesses.

Other findings include:

Capital Spending Steady: 61 percent plan capital spending, little changed from the spring survey (59 percent). Technology equipment leads the list of investment priorities.

Little Interest in New Loans: Despite keeping spending plans on track, eight out of 10 (82 percent) say they will probably or definitely not take out a new loan or line of credit in the next six months. This represents the lowest demand for credit in the history of the survey.

Pricing Pressures Build: Just over one-third (35 percent) plan to raise prices and only seven percent intend to cut, which is similar to the pricing pressures identified last spring. More than half plan to increase prices more than two percent, which is the upper bound of the Federal Reserve’s preferred inflation “target range.”

In a sign that small businesses will remain resilient amid the nation’s sluggish economic state, eight out of 10 hope to grow their business over the next two years.

The mood brightens for some in the fourth quarter of this year, as three out of 10 owners expect a ‘gift’ of higher profits this holiday season compared to a year ago.

Among them, 70 percent expect profits to increase by at least six percent. Meanwhile, 41 percent foresee no change in profits from last year and 29 percent expect a decline.

The PNC Economic Outlook survey was conducted in August and September 2011, by telephone within the United States among 1,460 owners or senior decision-makers of small and mid-sized businesses with annual revenues of $100,000 to $250 million.

The results are based on interviews with 504 businesses nationally, while the remaining interviews were conducted among businesses within the states of Florida, Illinois, Indiana, Missouri, New Jersey, Ohio and Pennsylvania.