One in Five Americans Expect to Die in Debt: Survey

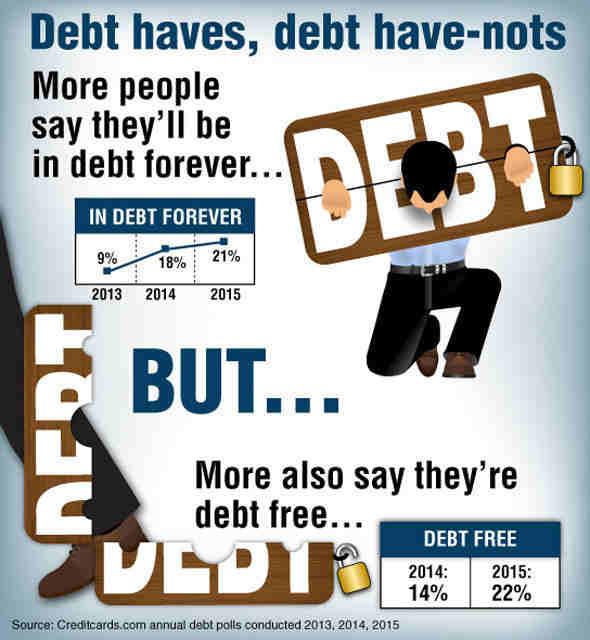

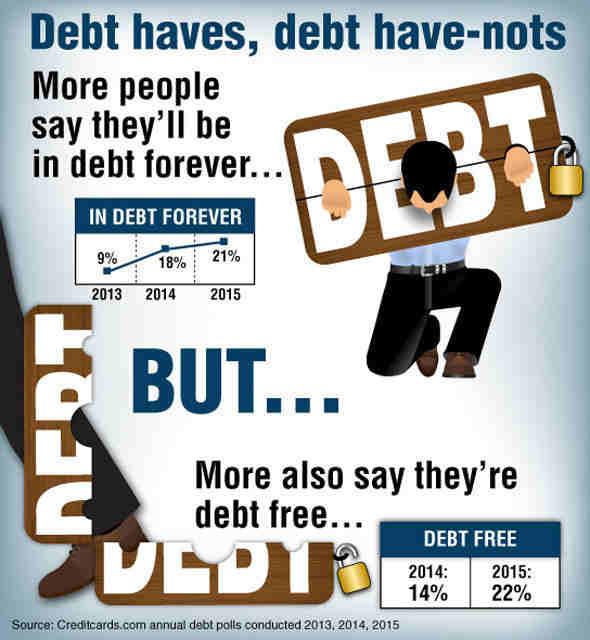

America continues to polarize into a nation of haves and have-nots when it comes to debt, according to a new CreditCards.com survey.

The survey shows that the number of Americans with no debt is growing, but so is the number of indebted Americans who say they’ll never get out.

More than one in five Americans with debt (21%) believe they will never pay them all off, according to survey data released Wednesday.

[ Has Obama Failed in the Fight Against ISIS Terrorism? ]

That’s up slightly from 18 percent last year and sharply from just nine percent in 2013. However, 22% of all Americans said they don’t have any debt at all, which is up from 14% last year.

Other highlights:

- The average age that Americans expect to be debt free is 54 (including credit card debt, car loans, student loans, mortgages, etc.).

- Among those in debt, about half (48%) say they’ll remain in debt until age 61 or later.

- Surprisingly, debt-ridden millennials are more optimistic about their finances than any other age group; only 11% claim they’ll never be debt-free.

- People with no children are more likely to say they’ll never get out of debt than parents are (23% to 17%).

- About one in four whites say they’ll never get out of debt. That’s more than minorities (24% to 16%).

- Republicans are almost twice as likely as Democrats to expect to die in debt (25% to 14%).

“It’s a troubling divide,” said Matt Schulz, CreditCards.com’s senior industry analyst. “While it’s great to see more people freeing themselves from debt, the fact that more and more people still feel trapped and hopeless means that Americans still have a major problem with debt.”

[ Did Hillary Clinton Mislead the American People? ]

For those who are looking to take hold of their debt, Schulz advises to create sensible budgets and track all expenses. He also suggests seeking out zero-percent interest balance transfer offers as well as negotiating lower interest rates on your current credit cards, if possible.

“Hopelessness can be paralyzing,” Schulz said, “but the reality is that people have more power of their debt than they realize. The most important thing is simply to take action – even small ones – to start knocking that debt down.”

The survey was conducted by Princeton Survey Research Associates International (PSRAI) and can be seen here.

PSRAI obtained telephone interviews with a nationally representative sample of 1,004 adults living in the continental United States. Interviews were conducted by landline (502) and cell phone (502, including 290 without a landline phone) in English and Spanish by Princeton Data Source from November 19-22, 2015.

CreditCards.com is a leading online credit card marketplace.