Arun Jaitley Says GST Enjoys Support of PM Modi

Tax is the money that ordinary citizens and businesses are forced to give to the government thieves who squander that money at will. Click here to read more.

Government of India celebrated the 1st GST Day in Delhi on Sunday. The event saw an address on the 1st year journey of GST (Goods and Services Tax) over a live video link by an Indian minister, Arun Jaitley.

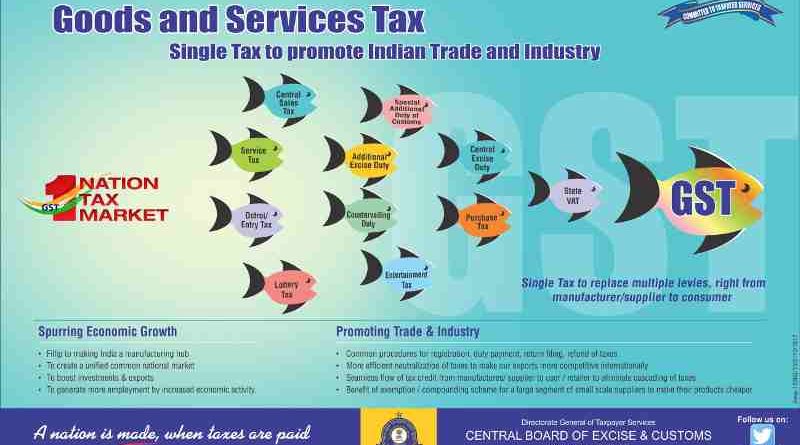

The minister recalled the pre-GST taxation system in India was one of the most complicated tax systems in the world. GST, according to Jaitley, has persuaded people to do businesses in a transparent manner without evading taxes.

Jaitley said that GST had an unequivocal support of the Prime Minister of India Narendra Modi, hence the Union Government could work closely with the States in a coordinated and collaborative fashion to make GST a success.

“We analyzed reasons why past Governments could not implement the GST. We resolved all issues raised by the States and assured them the immunity from fall in their revenue collection. The GST Council is India’s first consensus based federal decision making body”, the minister said.

[ क्या लोक सभा चुनाव के बाद मोदी एक नये और समृद्ध भारत का निर्माण कर पायेगा? ]

Listing out the successes that the GST has achieved in a short span of 1 year, Jaitley said that this reform has created a unified market, the cascading of taxes has been eliminated, the weighted average of total taxation basket has come down, the GST Council is working upon continuous rationalization of tax slabs, advance direct tax payments increased as result of successful implementation of GST, among others.

He informed that the total indirect tax collection for 9 month period in previous financial year post implementation of GST is about Rs. 8.2 lakh crores, which if extrapolated for the whole year comes to about Rs. 11 lakh crores, an 11.9% increase in indirect tax collections.

Talking about the capacity to rationalize present GST slabs, Jaitley said that the GST Council is constantly working in that direction and the desired rationalization will come with the setting in of the stability of GST system, increasing tax collections through curbing tax evasion and increasing the tax net.

The minister said that according to his projection, an increase of 1.5% in indirect tax collections is expected in the non-oil category, which will facilitate the automatic rationalization of tax slabs in near future.

Photo courtesy: Press Information Bureau